Section 22 of the house property

- The concept of Annual value and the method of determination is laid down.

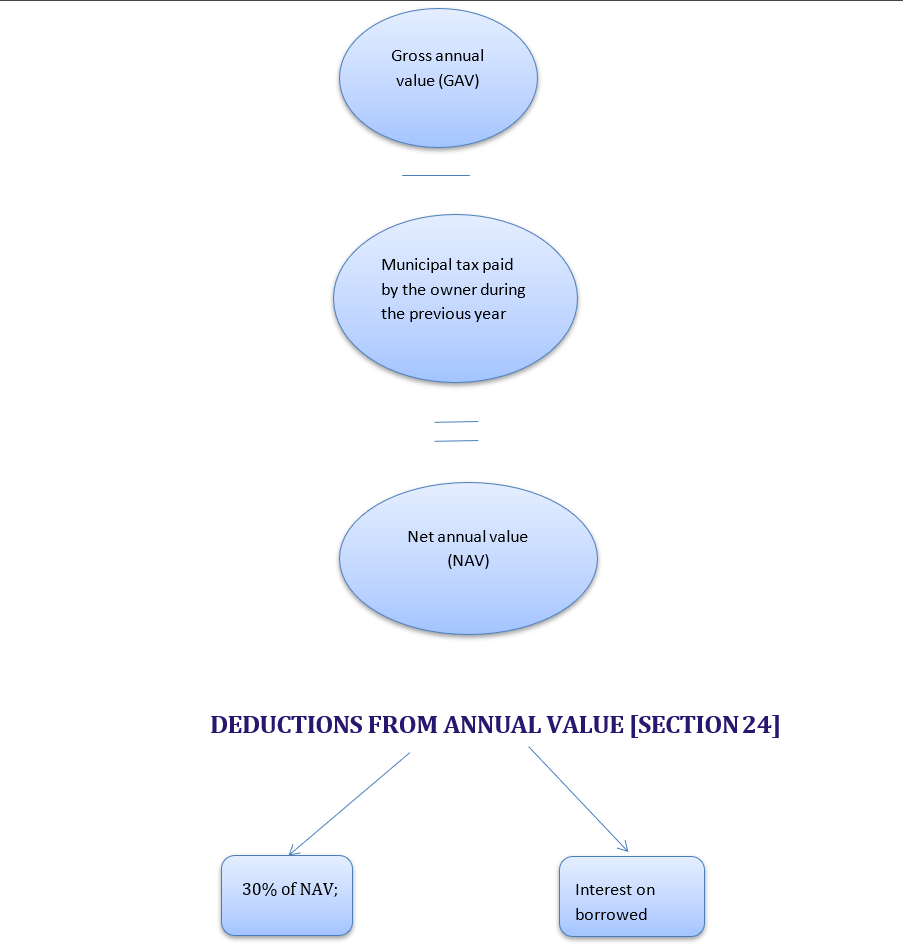

- The annual value of property comprising building and land appurtenant thereto, of which the assessee is the owner, is chargeable to tax under the head house property after deductions.

The following properties are chargeable under the head “Profits and gains of business or profession”

- Portions of a property occupied by the assessee for any business or profession carried on by him.

- Properties of an assessee engaged in the business of letting out of properties.

CONDITIONS FOR chargeability

- Property should consist of any building or land appurtenant thereto.

- The assessee must be the owner of the property.

- Use of property

- Property held as stock-in-trade etc.

Determination of annual value for different types of house properties

- Where the property is let out throughout the previous year.

TREATMENT OF INCOME FROM CO-OWNED PROPERTY [SECTION 26]

- Where property is owned by two or more persons, whose shares are definite and ascertainable, then the income from such property cannot be taxed as income of an AOP.

- The shared income of each such co-owner should be determined following sections and included in his assessment.

- Where the house property owned by co-owners is self-occupied by each of the co-owners, the annual value of the property will be Nil and each co-owner shall be entitled to a deduction of 30,000 / 2,00,000, as the case may be, under the relevant section on account of interest on borrowed capital.

However, the aggregate deduction of interest to each co-owner in respect of interest payable on loan taken for co-owned house property and interest, if any, payable on loan taken for another self-occupied property owned by him cannot exceed 30,000/ 2,00,000, as the case may be.

Assesse must be the owner of the property

- The owner means a person who is entitled to receive income from the house property.

- He need not be a registered owner.

- The owner may be freehold or leasehold.

- The assessee must be the owner in the previous year he need not be an owner in the assessment year.

- In the case of disputed ownership, until the judgment from a court of law, the Income-tax department will decide in

- Whose hands income shall be taxable?

- In case of subletting since the assessee is not the owner of the building sublet, hence the income derived therefrom Shall not be taxable as income of house property (Taxable under head other sources