“Agriculture Income” means-

- Any rent or revenue received from the land which is situated in India and is used for agricultural purposes;

- Any income derived from such land by agricultural operations including processing of the agricultural products raised or received as rent in kind so as to render it fit for the market, or sale of such produce;

- Income is attributable to a farmhouse.

Any income derived from saplings or seedlings grown in a nursery shall be deemed to be agricultural income.

Exemption Hormonas Péptidos of Agricultural Income from tax:

Agriculture income is exempt from tax under section 10(1). However, in a few cases agricultural income is taken into consideration to compute tax on non-agricultural income.

Tax on non-agricultural income, where assessee earns agricultural as well as non-agricultural income:

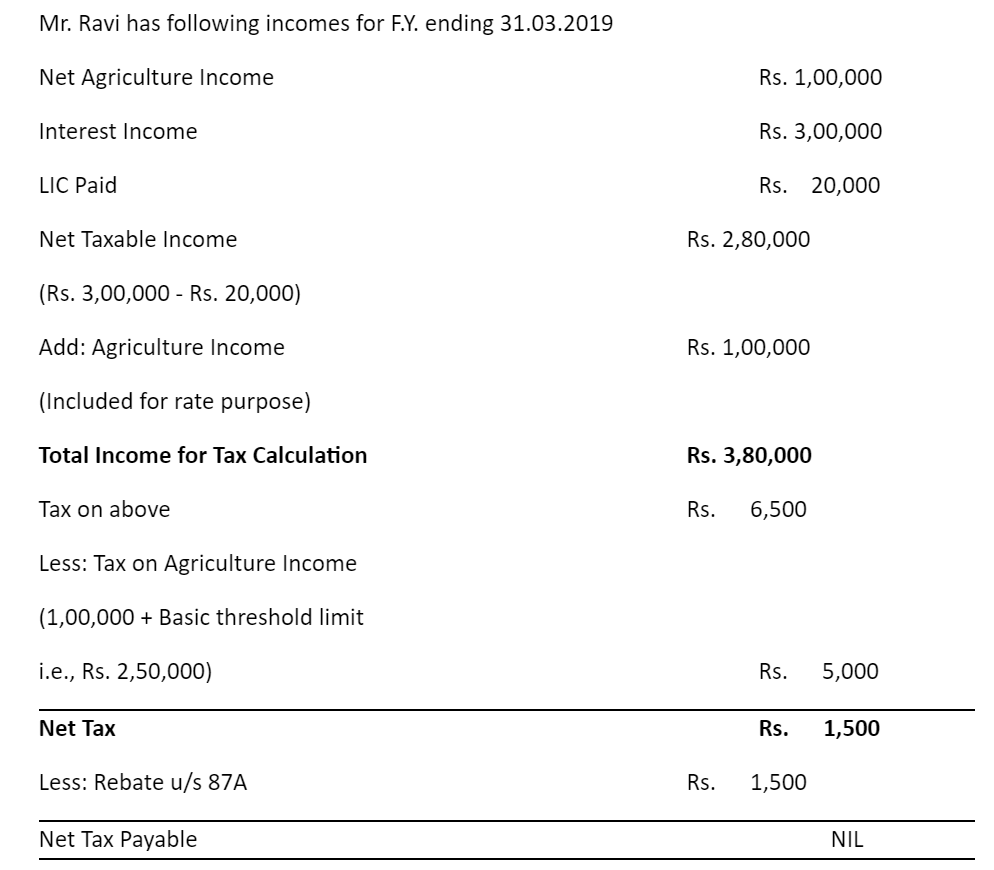

In case the assessee is an individual or Hindu undivided family or association of persons or body of individuals or an artificial judicial person and he earns agricultural income more than Rs. 5,000 and non-exemption limit: income tax will be computed for the assessment years 2018-19 and 2019-20 in the following manner:

- Net agricultural income is to be computed as if it were income chargeable to income tax.

- The agricultural and non-agricultural income of the assessee will then be aggregated and income tax is calculated on the aggregate income as if such aggregate income were the total income.

- The net agricultural income will then be increased by an amount of exemption limit and income tax is calculated on net agricultural income, so increased, as if such income was the total income of the assessee.

- The amount of income tax determined at step 2 will be reduced by the amount determined under step 3.

- The amount so arrived at will be the total income tax payable by the assessee before giving rebate under section 88E; before adding a surcharge on income tax and before adding education cess on an aggregate of income tax surcharge.

Example:

AGRICULTURAL LAND

Capital gains on the sale of agricultural land bring the issue of whether the said agriculture land is a capital asset. If the said agricultural land is not capital asset within the definition of section 2(14) of the Income Tax Act, the gain on an agricultural land sale shall be exempt from Income Tax. If agricultural land is situated in a rural area then capital gain from the sale of such land will not be chargeable to tax.

To determine whether agricultural land is rural or urban following conditions are checked:

- Whether it is situated in any municipality or cantonment population of which is more than 10,000; OR

- Whether it is situated within distance from the municipality or cantonment board:-

- Not being more than kilometers from the local limits of any municipality or cantonment which has a population of more than ten thousand but not exceeding one lakh; or

- Not being more than six kilometers, from the local limits of any municipality or cantonment board which has a population of more than one lakh but not exceeding ten lakh; or

- Not being more than eight kilometers, from the local limits of any municipality or cantonment board which has a population of more than ten lakh.

If any of the above conditions are satisfied, the said agricultural land is urban land & sale of such land will be chargeable to tax as a capital asset.