What is ITR?

Income Tax Return (ITR) is a form in which the taxpayers file the information regarding the total income earned during the financial year and compute the tax applicable to his income computed for that financial year to the income Tax Department. The Income Tax Department notifies 7 various kinds of ITR forms i.e. ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 & ITR 7 to date. The applicability of various forms depends on the source of income earned by the taxpayer, amount of income earned and the category of taxpayers like individual, HUF, company, etc. The taxpayer should file its ITR before the specified due date given by the department.

Which ITR to be filed?

The basic ITR form applicable to a salaried person is ITR 1, it applies to an individual resident taxpayer who has a total income of up to Rs.50 lakhs. He can file income from salary, one house property, income from other sources like interest income and agriculture income up to Rs.5000.

ITR 1 not applicable if:

- If you have income from more than one house property.

- When you have a taxable income under the head business & profession.

- If you have taxable income under the head of capital gains.

- Taxable income exceeding Rs.50 Lakhs.

- When you are a Director of a company.

- If you have an agricultural income more than Rs.5000.

- Having income from lottery, gambling, legal batting, etc.

ITR 1 form is segregated into :

- Part A: Individual personal details.

- Part B: Its Gross total income.

- Part C: Deduction and total taxable income.

- Part D: Total tax computation

- Schedule IT: Details of Advance tax paid and Self assessment tax paid.

- Schedule TDS: Details of tax deducted at source ( TDS which is deducted by employer or from any other authorities like a bank who deducted TDS on interest on fixed deposits)

List Documents Required to file ITR 1 :

- Aadhaar card of an individual.

- Pan card of an individual

- Form 16 issued by the employer ( Form 16 provides all the information related to total income earned by the employee from the organization in the form of basic salary, dearness allowance, house rent allowance, and other perks the deductions allowed and the tax deducted by the employer in the form of TDS).

- Bank statements for calculating the total interest income earned by the individual from different banks.

- Bank investment certificates like the FD certificates.

- Form 26 AS so that you can find the total income as well as total TDS deducted on that income and to verify that total TDS shown in 26 AS is matches the FORM 16 issued by the employer.

- Documents of deduction you want to claim under different sections like 80C or 80D if you have not been able to claim the deduction from the employer on time.

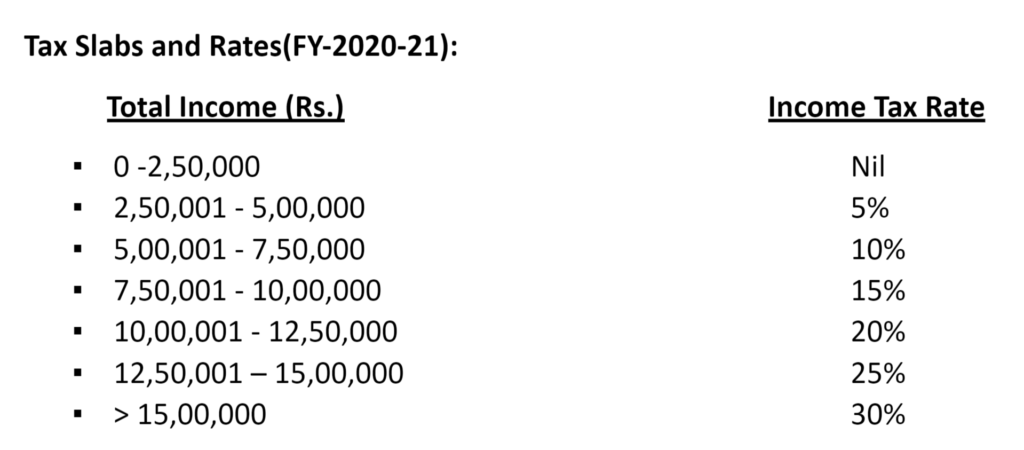

However, individuals having net taxable income up to Rs.5,00,000 will be able to avail tax rebate of Rs.12,500 under sec 87A, so effectively no income tax has to pay up to a net taxable income of Rs.5,00,000.

ITR filing may seem to be a cumbersome process if you have more than one source of income. You must choose the right form and fill in the right details as per the Income Tax Act, 1962. This is where ValBz comes into the picture. We have experienced professionals in this field, who will choose the right form and do your filing as required by the law. Just visit the website or download the app and choose the most suitable plan(or you can connect with us online to help you choose the right service).

ITR filing has to be as per the law, else we may get summons/notices from the Income Tax Department.