Charitable trusts are the trusts which are formed charitable purposes like- to provide relief to poor, medical relief, education, preservation of environment/ monuments, the advancement of objects of general public utility, religious purpose, etc. Their taxation has always been a subject of concern. The income of such trust is taxed as per the provisions of section 11-13 of the Income Tax Act, 1961 rather than as per their relevant provisions. Let us discuss the major areas related to taxation of income of such charitable/religious trusts.

Income tax on Charitable Institution or Trust

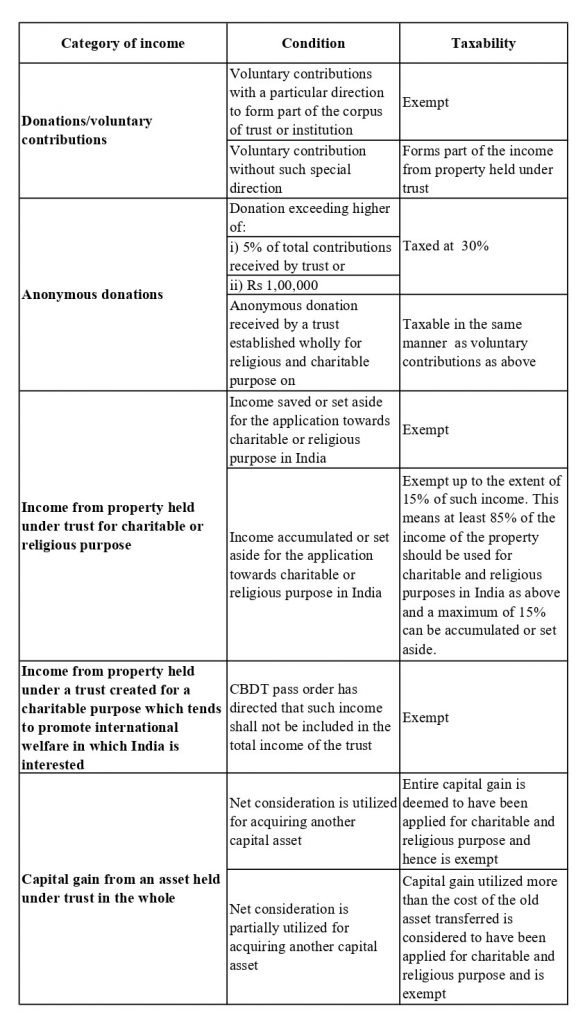

We have discussed below income tax on various categories of income of charitable trust:

How should income be applied to be exempt

To be exempt, trust is required to apply at least 85% of its income to charitable or religious purposes in India. As per the definition provided under tax provisions, charitable purpose includes the following:

- Relief of the poor

- Education

- Yoga

- Medical relief

- Preservation of environment or places or objects of artistic or historic interest.

Where should accumulated income be invested?

Such accumulations must be through the following modes of investment:

- Investment in government saving certificate/UTI

- Deposit in post office savings bank/scheduled bank/co-operative bank

- Investment in IMP (immovable property)

- Investment in any security for money created and issued by the CG or SG

- Company debentures fully and unconditionally guaranteed by CG or SG

- Investment or deposit in the public sector company

- Deposit with or investment in bonds of a financial corporation or public company engaged in providing long term finance for India’s industrial development